Worldwide, the non-stop churn of sustainability news and regulatory updates continued in the second quarter of 2025, with no signs of slowing during the remainder of the year and beyond. Silver continues to track the latest developments on California’s climate bills; the web of regulation in the EU; and ongoing input on manager ESG practices from investors and regulators alike. While each update may be individually vital in its own right, these highlights collectively represent just the tip of the iceberg of an increasingly complex disclosure environment.

Here’s our look at the key updates from the past quarter:

California SB 253 & 261 Updates

The California Air Resources Board (CARB), the regulatory body overseeing rulemaking and implementation of California’s upcoming climate disclosure rules, recently held a public workshop to provide updates on the status of rulemaking efforts and initial feedback on topics from the comment period. Staff indicated that CARB is aiming to have rulemaking completed by year-end and provided updates on key definitions, most notably the “doing business in California” threshold that will determine the scope of SB 253 and SB 261. While not final, these updates suggest an initial preference to harmonize regulatory definitions with existing frameworks such as California’s Revenue and Taxation Code. Notably, CARB staff and state legislators made clear that reporting deadlines (2026 for SB 253, and on or before January 1, 2026, for SB 261, respectively) would not change despite CARB’s ongoing rulemaking and solicitation of stakeholder feedback.

Silver’s Take: As CARB continues gathering stakeholder input to determine scoping and implementation regulations ahead of upcoming deadlines, companies that may be in-scope of the requirements should monitor developments closely to ensure preparedness for the initial 2026 reporting deadlines. Silver is assisting both clients and portfolio companies to ensure compliance with California’s new climate agenda.

Trump Administration Works to Reshape State Climate Policy through an Executive Order

The Trump administration continues to reshape the climate policy landscape, most recently with an executive order aimed at dismantling state-level environmental regulations. Titled Protecting American Energy from State Overreach, the order claims that such laws violate constitutional principles by “projecting the regulatory preferences of a few states into all states.” It directs the U.S. Attorney General to identify and challenge any state laws addressing climate change, ESG or carbon emissions. This includes California’s cap-and-trade program, state-led climate liability lawsuits and Climate Superfund laws that have recently been passed in New York and Vermont, which impose retroactive fees on companies’ historic emissions.

Silver’s Take: We urge investment managers to remain cognizant of changes to the regulatory landscape as the Trump administration continues to advance its policy agenda.

New York Pension Funds Require Strong Net-Zero Action Plans

New York City Comptroller Brad Lander announced that the city’s pension funds will terminate relationships with asset managers who fail to submit comprehensive net-zero action plans by the end of June this year. Per Comptroller Lander, asset managers must go beyond portfolio decarbonization and demonstrate real economy engagement, integrate material climate risks and opportunities into investment decisions and adopt strong stewardship strategies to support decarbonization. NYC also expects managers to ensure portfolio companies measure and reduce Scope 1, 2 and 3 emissions; align capital expenditures and lobbying with climate goals; and address the workforce and community impacts of the low-carbon transition. This announcement was framed as a countermeasure to federal climate policy rollbacks under the Trump administration.

Silver’s Take: Managers and similar investors should continue monitoring this action to ensure their approaches to climate risk remain aligned with investor expectations. This announcement, coupled with State Street’s recent loss of a $30 billion allocation from the UK pension fund, The People’s Pension, signals that pro-ESG investors are beginning to actively disassociate from managers who are deemed to be lagging on sustainability-related issues.

Updates on the UK’s SDR and Modern Slavery Regimes

The UK Financial Conduct Authority (FCA) has announced that it will not proceed with its proposal to extend the Sustainability Disclosure Requirements (SDR) and investment labels to portfolio managers. Introduced in April 2024, the proposal aimed to expand the regime, originally designed for retail investors, to include wealth managers and model portfolios. However, after reviewing feedback from its industry consultation, the FCA decided to pause the expansion, citing implementation challenges, requests for additional time and the need for greater clarity on labelling and disclosure standards.

Meanwhile, the UK Home Office released the most significant update in nearly a decade to its guidance under the Modern Slavery Act. The revised guidance clarifies the expectations for annual Modern Slavery statements required from organizations operating in the UK with a turnover above £36 million. It also outlines detailed content on topics such as company structure and supply chains, policies, due diligence, risk assessment, monitoring, training and continuous improvement.

Silver’s Take: Managers operating in the UK should remain cognizant of ongoing regulatory developments to ensure they are aligning disclosures and practices with the latest guidance.

Danish Regulator Reprimands Asset Managers for SFDR Failings

Three investment managers have been formally reprimanded by the Danish Financial Supervisory Authority for failing to meet key legal obligations under the EU’s Sustainable Finance Disclosure Regulation (SFDR). The regulator identified one or more significant deficiencies in each firm’s sustainable investment processes, including inadequate measures to ensure that investments do not cause significant harm to environmental or social objectives (the Do No Significant Harm (DNSH) principle), vague or insufficient criteria for assessing sustainability in companies undergoing transition and incomplete consideration of mandatory Principal Adverse Impact (PAI) indicators.

Under SFDR, sustainable investments are required to contribute to an environmental or social objective, avoid significant harm and uphold good governance practices at investee companies. The Danish regulator concluded that the three firms had not sufficiently integrated these legal standards into their investment decision-making frameworks.

Silver’s Take: Firms managing SFDR Article 8 or 9 funds should ensure practices are aligned with the relevant disclosures made under each Article designation, including the proper application of good governance practices, the DNSH principle and consideration of PAIs.

EU Parliament Publishes Draft Amendments to Omnibus

The European Parliament’s Omnibus negotiator has published draft amendments to the European Commission’s Omnibus proposal, advocating for significantly deeper cuts to sustainability reporting requirements and the number of companies covered under the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CSDDD). While the Commission had already proposed raising the CSRD threshold from 250 to 1,000 employees, the newest draft pushes these thresholds even higher to 3,000 employees and €450 million in revenue, further narrowing the regulation’s scope.

The draft also limits supply chain reporting expectations, removes mandatory climate transition plans and eliminates the ability of member states to enforce stricter due diligence requirements. While aimed at reducing burdens for businesses, the proposals are expected to complicate Parliament’s ability to reach consensus, with positions already deeply divided.

Silver’s Take: Ongoing complications with the EU Omnibus package intended to reduce the scope and complexity of CSRD, CSDDD and other key legislative actions will be a key topic to follow for the remainder of 2025.

PRI Update

The 2025 PRI Transparency Reporting season is officially underway, with Signatories able to enter responses into the PRI reporting portal, and final submissions due July 30. To aid this effort, Silver recently published a guide to 2025 PRI Reporting. We have summarized the piece below and provided an update on the PRI’s new Progression Pathways initiative.

What has Changed in the Framework?

The 2025 Reporting framework remains largely unchanged from 2024, with fewer than twenty total changes. However, several of these updates could influence how Signatories prepare and present their responses, including the new ORO Module, which contains two questions on a Signatory’s (i) regulatory; and (ii) voluntary sustainability reporting efforts, outside of the PRI. In addition, the PRI has made various language refinements and assessment adjustments across the framework.

The most important change to the reporting process this year is the introduction of the “partially mandatory” reporting route. First announced in December 2024, this option allows any Signatory who has previously publicly reported to the Transparency Framework the option to report only on the Senior Leadership Statement and ORO Module and forgo other disclosures. Importantly, this route will result in a Signatory not receiving an assessment for 2025 and is not available for Signatories who have not publicly reported previously.

Silver has seen a mixed reaction across our client base, and the PRI community at large, to the partially mandatory option. Many of our clients have chosen to continue reporting in full, as in previous years, but other Signatories are jumping at the chance to reduce their sustainability disclosure obligations. When deciding on their reporting route for 2025, Signatories should consider side-letter obligations related to PRI Reporting, investor expectations, assessment pressures and other factors.

PRI in the News

Recent legal and political developments continue to place signatory organizations, such as the PRI, under scrutiny in broader debates around ESG. While these headlines are often driven by anti-ESG sentiment, they contain important takeaways for Signatories, especially those navigating regulatory uncertainty in the United States. Importantly, Silver has not yet observed significant, concentrated pushback against PRI Signatory status, but here is additional Silver PRI insight.

While certain headline news and general anti-ESG sentiment may create a false sense of alarm for PRI Signatories, in Silver’s view the PRI and its Signatories are relatively insulated from more discrete pushback from anti-ESG actors due to the broad nature of the PRI’s mission and the minimal requirements to establish and maintain Signatory status. However, voluntary participation in certain PRI-backed activities, such as Climate Action 100+ or other collaborative engagement efforts, may open Signatories to greater risk from the anti-ESG contingent. Silver urges Signatories to be mindful of their commitments and disclosures on an ongoing basis.

Progression Pathways Update

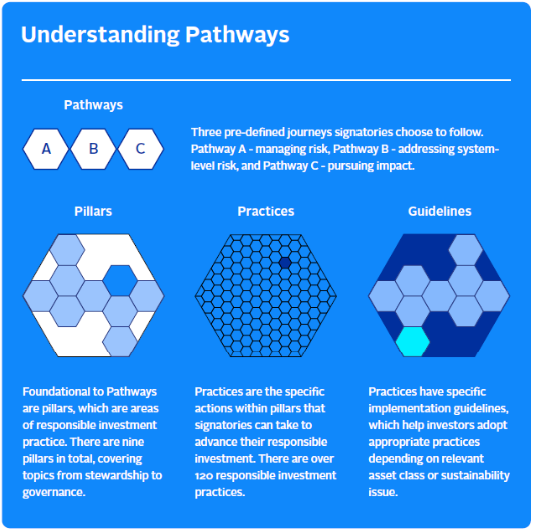

The Progression Pathways initiative, PRI’s upcoming rework to Transparency Reporting, has been top of mind for many Signatories. In April, the PRI released an update that shares an example implementation guideline and a preview of how pillars and practices will be structured. More recently, PRI circulated a document previewing its implementation guidelines. These guidelines provide an overview of best practices, practical steps for implementation and bespoke guidance specific to asset classes and sustainability topics. Guidance is expected to be sorted by pathways, pillars and practice descriptions that will assist Signatories in advancing their responsible investment journeys. See the graphic below for more details:

Graphic via the recently published PRI’s Progression Pathways Guide

Though not yet live, the pathways are positioned to become an important tool for long-term strategic planning and may soon influence how investors and stakeholders evaluate PRI participation. Silver expects more meaningful updates on Progression Pathways in the second half of 2025, after this year’s Transparency Reporting window closes on July 30.

Conclusion

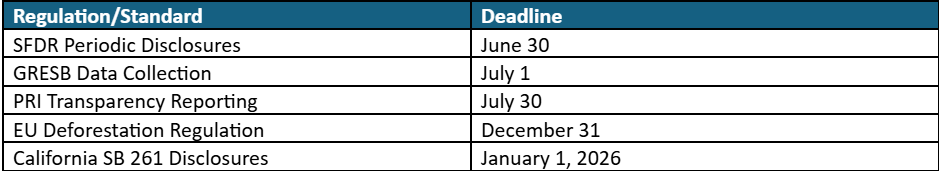

Sustainability regulatory updates and news continue to surface and hit the airwaves worldwide, as there is significant divergence in direction, policies, opinions, regulation and much more from region to region. Our recommendation to asset managers is to track both proposed and existing regulations and other requirements on an ongoing basis, as shifting scopes and requirements represent significant risk to the uninformed. To that end, here are some key upcoming sustainability deadlines to follow:

Please contact the Silver SRS Team at [email protected] for more information on our ESG services.

Read the latest from SilverVision

Stay ahead of the curve with SilverVision, Silver's blog dedicated to delivering up-to-date financial and regulatory insights.

Get SilverVision in your inbox. Subscribe now.

Why Private Fund Managers Can’t Treat the 2025 SEC Shutdown as a Free Pass

The SEC shutdown has left private fund managers navigating a rare period of regulatory silence —