On August 23, 2023, the SEC adopted sweeping changes to the Investment Advisers Act of 1940 to enhance the regulation of private fund advisers and update the existing compliance rule that applies to all registered investment advisers. Commonly referred to as the Private Fund Adviser Rules within the industry, these much-anticipated reforms are designed to protect private fund investors by increasing transparency, competition, and efficiency in the private funds market.

While different than the proposed amendments that were announced by the SEC back in February 2022, the enacted rules include several quarterly reporting requirements with respect to performance, fees and expenses, increased transparency regarding side letters and other “preferential treatment” for fund investors and limitations on the ability of fund managers to obtain reimbursement from private funds clients.

This topic continues to be top of mind for our clients, as they work to understand the impact of these new rules on their compliance program to ensure they can withstand regulatory scrutiny. The most frequent questions we are receiving from clients right now are mainly focused on preferential treatment, “legacy” provisions, whether side letters will no longer be permissible, reporting deadlines and how to manage these new mandatory disclosures, as well as third-party valuations and the fairness opinion necessary for adviser-led secondaries.

In short, these amendments are onerous, somewhat confusing and will require a lot of work for most private fund advisers who are trying to stay above board and meet regulators’ expectations. To help advisers be better prepared, the Silver Compliance team has put together the below guide to understand the most important takeaways from the Private Fund Adviser Rules, as well as the timelines to compliance.

The Rules Themselves

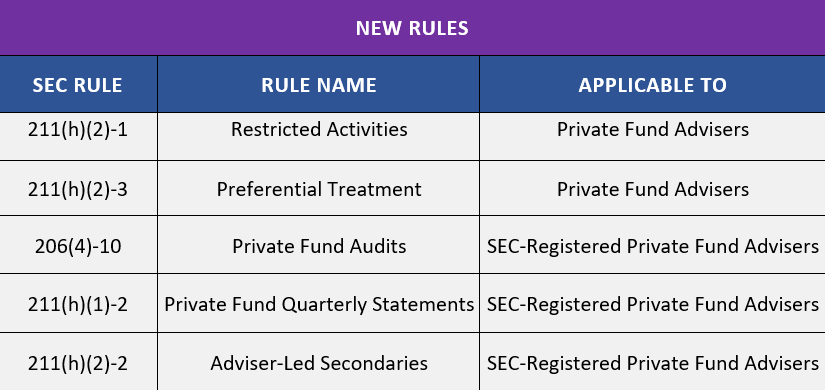

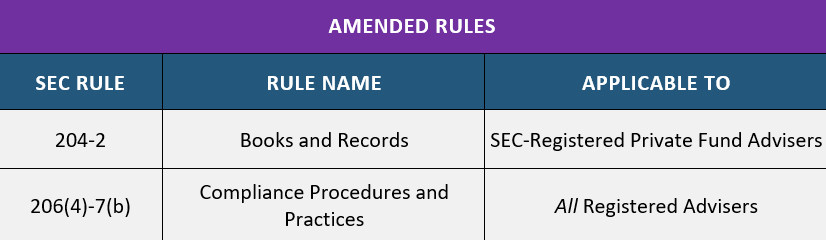

The SEC announced the following five new rules and the amendment of two existing rules:

Obligations for All Private Fund Advisers

Overall, the new rules affect nearly all advisers in some way. To break it down into more manageable content, some rules restrict all private fund advisers (both exempt reporting advisers and registered investment advisers) from engaging in certain activities unless they satisfy certain disclosure and, in some cases, consent requirements.

- Restricted Activities Rule – Disclosure Required

- Regulatory, Compliance and Examination Expenses:Private fund advisers cannot charge or allocate regulatory/examination/compliance fees or adviser expenses to the private fund unless these fees and expenses are disclosed in writing to investors within 45 days after the end of the fiscal quarter in which such charges occur.

- Reducing Adviser Clawbacks for Taxes: Private fund advisers cannot reduce clawback obligations by actual, potential, or hypothetical taxes, unless the pre-tax and post-tax clawback is disclosed in writing to investors within 45 days after the end of the fiscal quarter in which the clawback occurred.

- Certain Non-Pro Rata Fee and Expense Allocations: Private fund advisers are prohibited from charging or allocating fees and/or expenses related to a portfolio investment on a non-pro rata basis, unless the allocation approach is fair and equitable and the adviser distributes advance written notice of the non-pro rata charge and a description of how the allocation approach is fair and equitable under the circumstances.

- Restricted Activities Rule – Disclosure and Consent Required

- Investigation Fees and Expenses: Private fund advisers are prohibited from charging or allocating, to the private fund, any fees or expenses related to an investigation of the adviser without disclosing to, and obtaining consent from, the fund investors. Additionally, advisers are prohibited from charging fees or expenses for investigations that lead to, or have led to, a court or governmental authority imposing sanctions for violations of the Advisers Act or rules thereunder.

- Borrowing: Private fund advisers cannot borrow money, securities, or other private fund assets, or receive loans or extensions of credit, from a private fund unless the adviser discloses, and receives consent from, fund investors.

- Preferential Treatment Rule – Prohibited Activities

- Information: Private fund advisers cannot offer preferential information rights regarding portfolio holdings or exposures of the fund or a similar pool of assets that will have a material, negative effect on other investors in that private fund or in a similar pool of assets unless such information is offered to all fund investors.

- Redemption: Private fund advisers are prohibited from offering preferential redemptions from the fund, unless the ability to redeem is required by applicable law or the adviser offers the preferential redemption rights to all other investors without qualification.

- Preferential Treatment Rule – Disclosure Required

- Written Notice to Prospective Investors: Advisers must provide each prospective investor with a written notice outlining specific information about any material preferential economic terms that the adviser provides to other fund investors.

- Written Notice to Current Investors: Advisers must distribute a written disclosure of all preferential treatment provided to other fund investors on at least an annual basis.

Obligations for Registered Private Fund Advisers

In addition to the above that apply to all private fund advisers, the following only apply to registered private fund advisers, and one item applies to all registered investment advisers.

- Quarterly Statements Rule

- The new rules require registered private fund advisers to distribute a quarterly statement to private fund investors. The statement must disclose fund-level information regarding performance, the cost of investing in the private fund, fees and expenses paid by the private fund, as well as certain compensation and other amounts paid to the adviser. The statements must be distributed within 45 days after the end of the first three fiscal quarters of each fiscal year of the fund and 90 days after the end of each fiscal year of the fund. Statements must be distributed within 75 and 120 days, respectively, for fund-of-funds.

- Private Fund Audit Rule

- The new rules require registered private fund advisers to have the private funds they advise undergo a financial statement audit that meets the requirements of the audit provision in the Custody Rule (206(4)-2(b)(4)). The audit must be performed by an independent public accountant that is registered with, and subject to regular inspection by, the Public Company Accounting Oversight Board in accordance with US GAAP (or the equivalent for non-U.S. funds) and the auditor is required to notify the SEC of certain events (e.g., termination of the auditor’s engagement).

- Adviser-Led Secondaries Rule

- The new rules require registered private fund advisers to obtain a written fairness opinion or a written valuation opinion when offering existing fund investors the option (or choice) of selling their interests in one private fund, and converting or exchanging those interests for interests in another fund vehicle advised by the adviser.

- The rule also requires the adviser to prepare and distribute a summary of any material business relationships the adviser has, or has had within the prior two years, with the independent opinion provider to the private fund’s investors.

- Books and Records Rule Amendments

- The SEC amended the books and records rule (Rule 204-2) to require SEC-registered private fund advisers to keep records relating to the new rules. This includes records with respect to quarterly statements, annual audits, disclosures regarding restricted activities, fairness or valuation opinions, and disclosures regarding preferential treatment.

- Annual Reviews of Compliance Programs (all registered investment advisers)

- The new rules include amendments to the compliance rule under the Advisers Act requiring all registered advisers, including those that do not advise private funds, to document in writing the required annual review of their compliance policies and procedures.

Timing

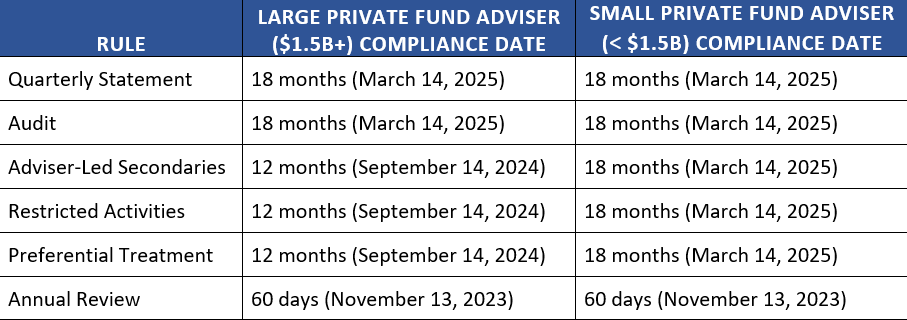

The new rules and amendments become effective in accordance with the following staggered transition periods:

Legacy Status

The rules provide legacy status for the prohibitions aspect of the Preferential Treatment Rule and the aspects of the Restricted Activities Rule that require investor consent. The legacy status provisions apply to governing agreements that were entered into prior to the compliance date if the applicable rule would require the parties to amend the agreements.

Key Takeaways

These new rules and amendments can have a material impact on private fund advisers, regardless of whether they are SEC-registered, and could significantly increase compliance costs. Moreover, these rules and amendments change long-standing, negotiated market practices applicable to private fund advisers. Although the compliance dates are relatively far off, advisers should begin to understand how the new and revised rules will affect their fundraising and operations once effective, including how legacy status may apply.

Ultimately, our view is that these news rules will require a lot more work from private fund advisers, but the utility of these reforms remain a bit unclear. What we do know is that the rules as enacted are far less transformational than what was originally proposed, which means there should be less strain felt around their implementation across the industry. We recommend working closely with legal counsel, auditors, third party service providers and compliance partners to ensure private fund advisers are covering all regulatory areas as mandated under these reforms. If you have any questions about these new rules, or questions about how to enhance your compliance program, please contact a member of Silver’s Compliance Team at [email protected].