In the aftermath of the Principles for Responsible Investment’s (PRI) decision to cancel 2022 Transparency Reporting, PRI Signatories may be scrambling to get up to speed ahead of the 2023 reporting cycle.

To support this effort and demystify the changes to the process, Silver’s ESG Team has compiled a practical guide for Signatories to help prepare them for 2023 Transparency Reporting.

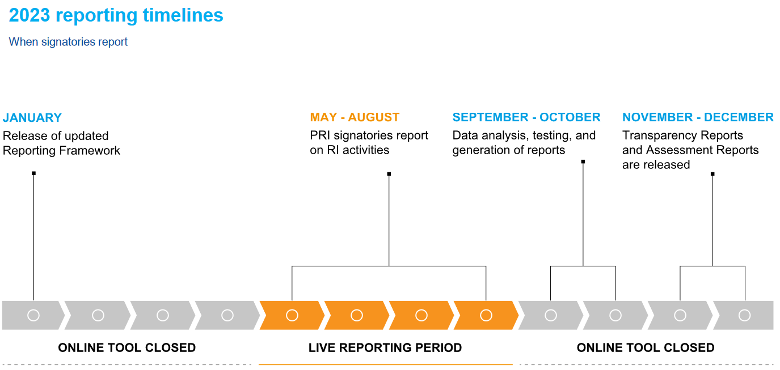

Reporting Timeline

PRI announced that the 2023 reporting cycle will open mid-May and will end in mid-August. Specific dates have not yet been announced and the following reference timeline remains the most up-to-date resource for Signatories.

[PRI provided the above timeline on pg. 29 of the 2023 Reporting Framework Overview. Please access here]

Step 1: Assess Changes

Signatories should begin their process for 2023 reporting with a review of relevant changes that have occurred since the previous reporting cycle. Key items to assess include:

- How the PRI Reporting and Assessment (R&A) Frameworks have changed

PRI has released several resources designed to guide Signatories through changes to the R&A Frameworks. These resources include an Overview and Structure Guide, Reporting Glossary and the 2023 Reporting Modules themselves. Signatories should familiarize themselves with these documents to understand what has changed since 2021 (and what has not). The most notable highlights include:

-

- The Investment and Stewardship Policy (ISP) module has been renamed the Policy, Governance and Strategy (PGS) module. The PGS module now contains all proxy voting questions, an expanded set of mandatory climate-related questions, as well as voluntary human rights questions.

- Certain indicators from the old ISP module have been transferred to a new module called Confidence Building Measures (CBM).

- Overall, the number of indicators applicable to Signatories has decreased; asset manager Signatories will be expected to respond to a maximum of 257 indicators, 188 of which are required (“Core”) indicators. The exact number of indicators will vary based on the logic for each indicator, asset-class module applicability, among other factors.

- How a Signatory’s ESG Practices have changed

In addition to assessing how PRI’s methodology has changed, it is key for Signatories to take stock of how their internal ESG processes have changed. Relevant topics to consider include:

-

- Changes to a Firm’s asset class exposure or investment strategy

- ESG Policy updates, amendments or alterations

- Evolution of stewardship and engagement practices

- ESG governance, including the role of any ESG-dedicated personnel or ESG decision-making bodies, such as an ESG Committee

- Approach to climate-related risk and opportunity

- Audit or other third-party verification of ESG reporting and practices

Step 2: Establish Baseline Responses

Next, Signatories should work to establish baseline responses to the 2023 PRI Reporting Framework. This process has three distinct phases:

- Understand applicable modules: PRI Signatories must report to a set of required modules, which include the Senior Leadership Statement (SLS), Organizational Overview (OO), PGS and CBM. Additionally, asset manager Signatories must determine which specific asset class modules they will be required to complete. An asset class module is required to be completed if the Signatory has greater than 10% of their AUM or greater than $10 billion USD in the respective asset class (Exceptions apply, please refer to the PRI Logic guide for more information). Additionally, asset manager Signatories may choose to voluntarily report to asset class modules that are not required, for example, as a way to demonstrate all of the firm’s ESG practices that are in place across each investment strategy.

- Review previous responses: For Signatories that reported in 2021, comparing 2021 responses to the 2023 Reporting Framework is integral to establishing baseline 2023 responses (many Signatories should expect their responses to change). The PRI has created a Mapping Framework to allow Signatories to easily transfer responses to the new framework. We urge prudence when using this tool – PRI introduced new questions in 2023 that will not have directly transferable predecessors from 2021.

- Use of Offline Modules: The final step is to fill in the relevant reporting modules. The PRI has provided both Word and PDF versions of offline modules to facilitate this process. Silver encourages Signatories to use the offline modules to determine the full scope of reporting requirements and the logic, guidance and assessment criteria associated with each indicator.

Additional resources for Signatories include the March 2023 PRI Webinar on preparing for the 2023 PRI reporting cycle and the PRI’s R&A Team, who are available via email at [email protected]. Signatories can utilize their PRI Relationship Manager to field logistical questions, but data-related and guidance-based questions are best directed to the R&A Team.

Step 3: Establish Rationale, Data Entry and Organizational Review

Once baseline responses have been established, Silver views the following best practices as imperative in submitting complete, timely and defensible Transparency Reports:

- Establish rationale: A common gap among Signatories is the lack of documentation and rationale for responses included in past Transparency Reports. Having established baseline responses, Signatories should ensure that appropriate documentation and rationale has been preserved in order to ensure that a Signatory can properly defend responses against potential investor and regulator scrutiny (and to help facilitate reporting in future cycles!)

- Data entry: While PRI has made offline modules available since late January 2023, the online Reporting Tool, which Signatories must use to submit their official reports, will not open until mid-May. Beginning the reporting process prior to the reporting tool opening is vital to ensuring that a Signatory can complete timely submission of its PRI Transparency Report.

- Organizational review: Once data has been added to the Reporting Tool, the final step before submission should be an organizational review of the completed PRI Report. In Silver’s view, it is key for relevant ESG, investment, compliance, legal and management personnel to review the submission file. A Signatory’s Transparency Report is publicly available and should be reviewed with a regulatory lens. Signatories should ensure that the answers provided in the CBM module with respect to submission review match its final review efforts.

Step 4: Understanding Assessment

As a reminder, only the PGS, asset-class and CBM modules are assessed by PRI. SLS and OO are not assessed. Signatories with Listed Equity and Fixed Income assets will receive separate scores for each relevant sub-asset class category.

PRI has confirmed that the five-star scoring framework, first implemented for the 2021 R&A process, will continue into 2023. However, the ranges used in 2021 to establish scoring will not be repeated for 2023; instead, new ranges will be established after the reporting period. As such, Signatories will have limited ability to self-assess prior to submission. Further limiting self-assessment capabilities, the PRI has yet to release weighting for individual indicators.

Silver’s PRI Support Services: Silver partners with PRI Signatories in a variety of ways, including conducting PRI gap analyses for new or prospective Signatories and providing support and guidance during the Transparency Reporting cycle. Silver also conducts reviews of internally completed Transparency Reports for Signatories seeking third party evaluation. Silver’s PRI Signatory clients currently represent over $750 billion of combined AUM.