With liquidity across private markets reaching record highs in 2021, financial watchdogs have been very busy staying ahead of global investment activity. However, regulators and investors now have a lot more variables to consider than in years of cash rich past. Cryptocurrency, NFTs, sustainable goods and environmentally friendly business processes, to name a few.

As we look back on a year that seems to have moved at warp speed, Silver has created the following Top 10 list for compliance teams in the investment management industry to take into consideration for 2022, including:

- The emergence of cryptocurrency and remaining questions around how the digital asset space will be regulated;

- Three key areas for private fund managers focused on ESG and sustainable investment practices;

- Expanded guidance on proxy voting;

- Considerations for firms to take under the new “Marketing Rule”;

- Cybersecurity, which continues to loom as a top risk;

- Reminder on allocation and disclosure of fees and expenses;

- Importance of electronic communication monitoring and disaster recovery/business continuity planning amid a hybrid workforce;

- SEC’s focus on investment advisers’ principal and cross transactions;

- Anti-Money Laundering as a continued area of focus for the SEC; and

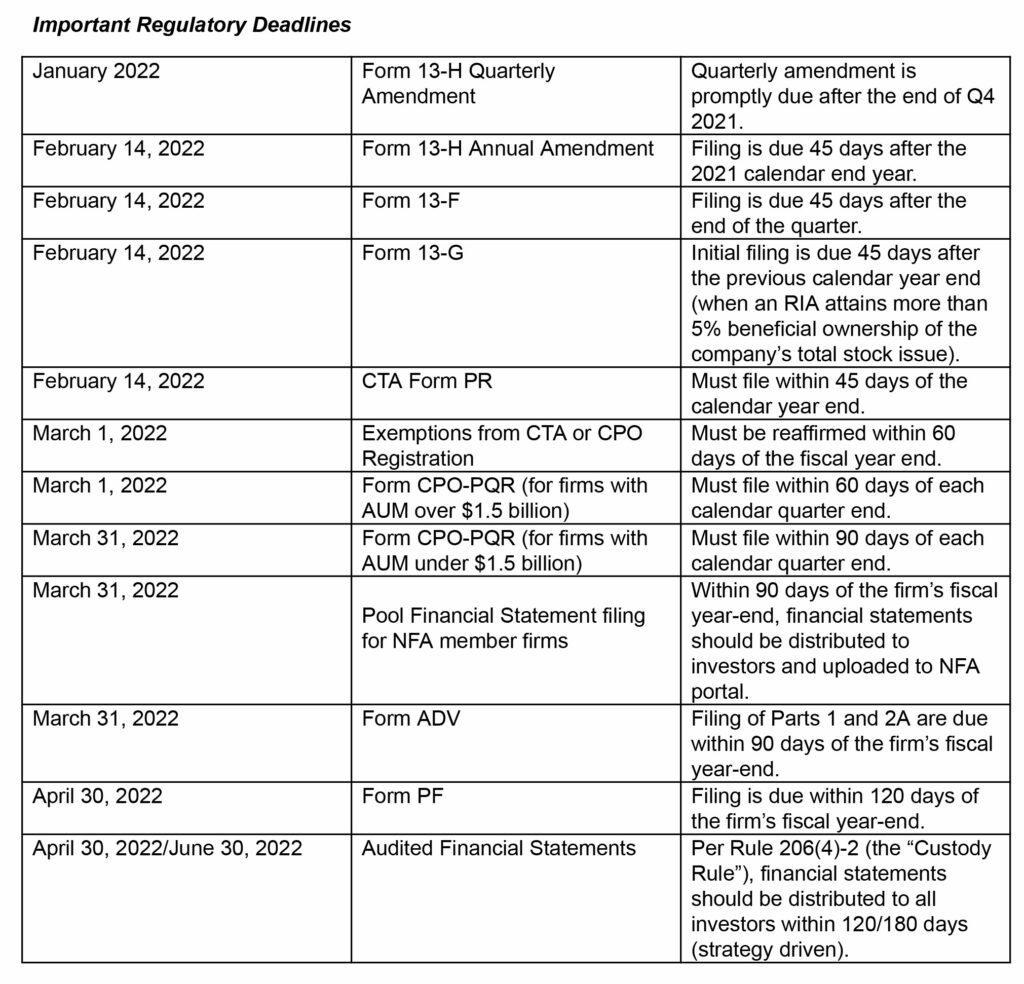

- Key dates and deadline reminders.

Are cryptocurrencies/digital assets securities?

The regulatory climate around crypto and digital assets continues to remain uncertain. While the SEC’s Fiscal Year 2021 Enforcement Results released in November highlight crypto as a major area of focus, the Commission continues to avoid directly answering the question, “Are crypto/digital assets securities?”, by circumventing the issue with enforcement actions against crypto exchanges and traders. In the case of Audet vs. Fraser, a private civil litigation, a Connecticut jury found “Hashlets” and the corresponding tokens issued by a miner were not securities. Although it may appear as a favorable outcome for crypto and digital asset traders, because this was a private matter not brought by a regulator, the question as to how these types of assets should be classified still needs to be answered.

Many industry players have requested to meet with regulators and educate them on crypto and digital assets to help formulate an appropriate and definitive framework for what Chairman Gensler has publicly deemed “the wild west.” However, regulators have yet to issue any clear response or guidance on how these assets will be regulated. In the meantime, even if crypto and digital assets are not regulated, Silver is helping crypto and digital asset private fund managers navigate this complicated regulatory space, whether by aiding them to comply with their obligation to register as an investment adviser and/or to employ best practice compliance policies and procedures which may eventually become required.

The rise of ESG

Some of the most significant regulatory developments to occur for asset managers over the past year were related to ESG and sustainable investment practices. In a separate in-depth Review & Outlook piece published last week, practitioners from Silver’s ESG Strategy practice review some of these changes in more detail and share recommendations on how managers can prepare for 2022 and beyond, including:

- How regulators are trying to stamp out greenwashing and what managers can do in response to better substantiate their sustainability claims and practices;

- How recent efforts to standardize sustainability disclosures for companies and investors will transform how managers are expected to collect, analyze and report data; and

- Why the launch of new industry standards, membership groups and initiatives (like the Net Zero Asset Managers Initiative) are creating a higher bar for managers, and what steps managers can take to keep up with the competition.

The full article can be read here.

Expanded Guidance on Proxy Voting

The SEC has undertaken a number of notable actions related to proxy voting over the past year, which are as follows:

- In April, the SEC provided guidance on how investment advisers should align proxy voting with ESG programs and that it should not directly contrast with stated ESG goals without providing an explanation.

- In November, the SEC assessed two rules that affect proxy advisory firms (e.g., Glass Lewis, ISS). Rule 14a-2(b)(9), under the Investment Company Act currently exempts proxy advisory firms from certain reporting obligations, but the proposed amendment requires advisory firms to provide advice to registrants that are subject to such advice at or before advice is available to proxy advisory clients. Additionally, clients of proxy voting advisory firms must be provided with registrants’ responses to proxy voting advice issued by such firms.

- Also in November, the SEC targeted shareholder voting with two new rulemaking actions: 1) the SEC confirmed amendments that prescribed further use of ‘universal proxy’ usage. During contested director elections, proxy cards must identify ALL director nominees, allowing for split tickets; and 2) this amendment broadens voting disclosure requirements across all director elections, contested or otherwise.

Although certain of these proposed and actual rulemaking updates may not be directly applicable to all separately managed account or private fund managers, it is Silver’s experience that the SEC will expect that these investment advisers incorporate this guidance as a part of the manager’s proxy voting policies and procedures.

New Advertising/Marketing Rule Goes into Effect

On May 4, 2021, the amendments the SEC made to the rules governing investment adviser marketing under the Investment Advisers Act went into effect. The amendments create a single rule (the “Marketing Rule”) merging together the current advertising and cash solicitation rules. The amended rules reflect the evolution in technology that has impacted how firms advertise their offerings since the previous rules were adopted over 45 years ago.

Firms will have until November 4, 2022 to fully comply with the new Marketing Rule. Advisers may begin to comply with the Marketing Rule at any time; however, they should ensure that they are complying with ALL new requirements. Advisers are not permitted to selectively choose which components of the new rule and the old rules they want to comply with ahead of the November 4, 2022 deadline. Key Provisions of the new rule are:

- The Marketing Rule adopted a more flexible approach to advertising compliance by creating a series of principle-based prohibitions.

- Updates on the presentation of performance including gross vs. net performance, hypothetical performance and related vehicle or predecessor performance.

- A shift in policy regarding the treatment of testimonials in advertisements. The new Marketing Rule will allow the use of paid testimonials and endorsements, as long as the adviser meets certain requirements.

Silver believes the impact of the Marketing Rule on a manager’s marketing policies and procedures could vary depending on the marketing efforts of that firm. If you have any questions on how the Marketing Rule may or may not impact your firm’s compliance policies and procedures, please contact Silver, as programs are not one size fits all.

Cybersecurity Remains a Top Risk

As shown through the inclusion of information security and operational resiliency in the SEC’s 2021 Examination Priorities and ongoing discussion across outreach programs and statements by the SEC, cybersecurity programs continue to be at the forefront of the SEC’s attention. Additionally, 2021 has seen a noteworthy number of enforcement actions resulting from firms’ failure to adopt adequate policies and procedures designed to protect against cybersecurity incidents. An enduring focus on information security highlights the obligation that advisers and broker-dealers have to think critically about how their firms have instituted, and should continue to enhance, a comprehensive cybersecurity program that includes appropriate corporate governance, active incident preparedness, continued risk identification exercises, employee training and the implementation of other information security controls tailored to the firm’s business.

Proper Allocation and Disclosure of Fees and Expenses Reminder

The proper allocation and disclosure of fees and expenses, and their associated conflicts of interest, remains a top priority of the SEC year over year and an area of routine review during investment adviser examinations.

The Division of Examinations issued a Risk Alert on November 10, 2021, which included findings and best practices warranting review by private fund managers to shore up their compliance program, identify deficiencies and undisclosed conflicts, and avoid falling victim to common industry pitfalls during their next examination. In Silver’s view, it is critical to ensure the adoption of policies and procedures that are in line with the SEC’s guidance, including appropriate fee and expense allocation policies commensurate with the manager’s strategy and fund structure; proper disclosure of such policies in the fund governing documents and regulatory flings; and periodic testing of the policies to ensure the firm is complying with its own guidelines and noting exceptions.

Electronic Communications Monitoring and Disaster Recovery Planning Amid Hybrid Workforce

It is important for investment advisers to remember that the rules pertaining to books and records require that all substantive business electronic communication must be recorded and stored for a period of no less than five years. In a hybrid or remote working arrangement, it is especially important for firms to emphasize that their employees must continue to conduct all substantive business electronic communications through firm issued accounts and messaging services. Firms should discourage business communications on non-company approved devices or platforms, as all business communications may be requested by regulators or opposing counsel in the event of litigation — which may include non-company accounts, devices and platforms — should it be discovered that such communications were taking place off firm issued accounts. All electronic communications include, but are not limited to, emails, instant messages, text/SMS, private messaging and other third-party applications.

Additionally, in light of continued disruptions to normal business operations in the past year, the SEC’s Division of Examinations continued to prioritize the review of firms’ Business Continuity and Disaster Recover Plans (“BCPs”). As firms begin to establish a ‘new normal’ post-COVID environment with respect to where employees will work, it is important to keep in mind potential impacts to a manager’s BCP. Whether returning to the office full time, adopting a hybrid schedule or allowing employees to work remotely, firms should make note in their BCPs of the different considerations that apply to each type of working environment.

Principal and Cross Transactions Reminder

In July 2021, the SEC’s Division of Examinations published a Risk Alert on investment adviser principal and cross trades and highlighted numerous violations that were uncovered during SEC exams. While the Risk Alert did not provide any new information on principal and cross trades, it served as a reminder that principal and cross trades remain an area of focus in both SEC exams and enforcement actions. Silver recommends that managers that engage in principal or cross trades ensure their policies and procedures related to such transactions include sufficient detail and are disclosed in the fund’s PPM and the manager’s Form ADV. Managers should also make every effort to document decisions and compliance surrounding principal and cross trades.

Anti-Money Laundering (“AML”) Obligations – Always Under the Lens of the SEC

While certainly not a new area of concern, the SEC’s Division of Examinations continues to prioritize examinations of broker-dealers and registered investment companies for compliance with AML obligations under the Bank Secrecy Act (“BSA”) and the USA PATRIOT Act. Specifically, the SEC seeks to ensure that these entities maintain adequate policies and procedures to identify and perform due diligence on their respective customers and to identify suspicious activity and money-laundering activities. Notably, on June 30, 2021, the Financial Crimes Enforcement Network (“FinCEN”) issued guidance on how non-bank financial institutions, including broker-dealers, should address and incorporate AML and Countering the Financing of Terrorism (“CFT”) priorities (the “AML/CFT Priorities”).

Silver recommends that managers maintain policies and procedures documenting the due diligence of their investor base at the time of subscription and annually thereafter. To that end, private fund managers should consider their investor base and business model against the SEC’s guidance and the rules under the BSA and the USA PATRIOT Act when developing or enhancing their respective AML policies and procedures.