The U.S. Securities and Exchange Commission (“SEC”) announced on February 15th some much anticipated proposed amendments to Rule 206(4)-2, the Commission’s Custody Rule, under the Investment Advisers Act of 1940, as amended (“Advisers Act”) as well as changes to reporting obligations under Form ADV.

This is in addition to changes made back in 2021, when the SEC adopted the new Marketing Rule (Rule 206(4)-1 of the Advisers Act), governing the marketing and advertising activities of investment advisers These rules included amendments to Item 5 of Form ADV, Part 1A requiring information about an adviser’s use in its advertisements of performance results, testimonials, endorsements, third-party ratings and references to its specific advice. The compliance date for these new rules was November 4, 2022; however, because these updates to Item 5 are not deemed to be a material change to the Form ADV, advisers were not required to update these responses until their annual amendments became due. This means that most advisers will be responding to new Item 5.L for the first time when they file their Form ADV annual amendment, many by March 31st, as well as grappling with some of the recent updates announced in February.

Registered investment advisers (“RIA”) and private fund managers should take extra caution when completing and submitting their Form ADV to ensure that mistakes are not made under the increasingly watchful eye of regulators this year.

The Compliance team at Silver works in lockstep with our clients to carefully complete Form ADV filings in painstaking detail, with a focus on advising our clients to implement updated guidance from the SEC that might impact regulatory scrutiny or an examination down the line. Utilizing feedback from our clients and our team’s experience in this area, we compiled the following common mishaps that can occur in the course of updating annual Form ADV amendments before the March 31st deadline:

- Make Sure You Have the Necessary Funds Available in Advance– The devil is in the details when filing Form ADV updates and this particular detail, while seemingly obvious, is often the first thing that is overlooked by RIAs, which can slow down the filing process. To avoid unnecessary delays and to ensure a timely Form ADV filing , Silver recommends that firms log into their IARD accounts no later than March 1, 2023 to confirm their account is adequately funded and is updated from an administrative standpoint (e.g., log-in credentials are accurate and passwords are updated).

- Collaborate with All Necessary Teams on Business Updates Early – Form ADV filings require firms to amend disclosures, such as regulatory assets under management (RAUM) and client / private fund information, among other details, if any changes were made since the last fiscal year filing. In order to update and verify the necessary information required for certain Form ADV data points, Silver recommends advisers meet with their investment and operations teams early in the first quarter of the new year to collect data relating to the description of investment activities and operations of the adviser; they should also organize their finance and accounting teams to begin collecting the firm’s RAUM. One important note regarding RAUM: estimated values are acceptable, as long as the adviser retains documented support substantiating the estimations. Additionally, for those advisers that work with a fund administrator, there are various reports that need to be collected and reviewed in advance of Form ADV filings, including those needed to disclose data specific to each private fund in Section7.B.(1) of Part 1A of the Form ADV. This can take some time, so it’s a good idea to begin these conversations as early as possible to ensure that necessary reports are in process and available when the adviser needs to file Form ADV.

- Don’t Wait Until the Last Minute to File – Form ADV filings are due on March 31st. As that date starts to creep up, the increased traffic to the IARD website can sometimes create processing and administrative slowdowns, adding more stress to this already arduous and complex process. Therefore, the Silver team recommends that firms think about filing a week early, if possible, in order to help prevent unnecessary glitches from impacting your ability to file on time.

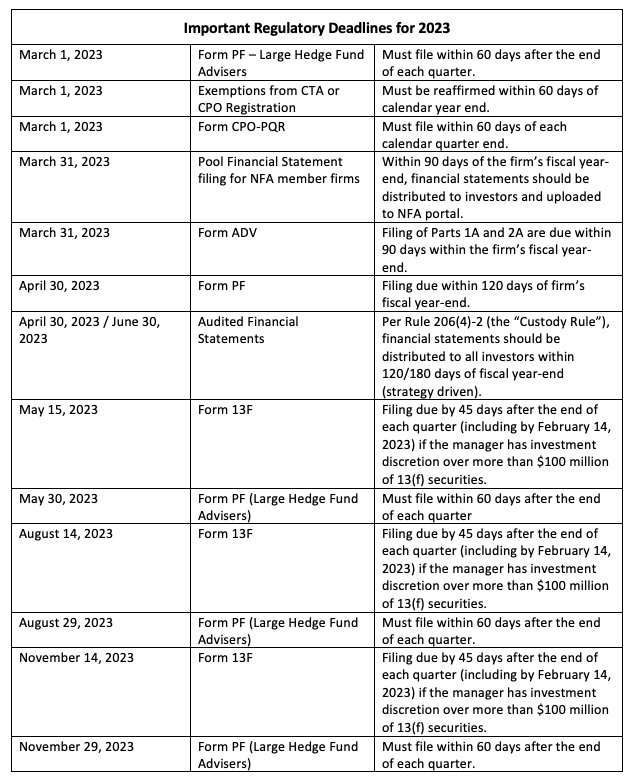

Additionally, given the groundswell with which the SEC is currently operating and the potential risks this might pose to private fund managers, we have compiled a chart outlining the remaining key regulatory filing deadlines in 2023 that all investment managers should have on their radars. If you have any questions about the below filings or are looking for insight on how to better navigate the new regulatory updates from the SEC this year, please reach out to Silver to learn about best practices for ensuring your firm stays out of the crosshairs of regulators.